From status quo to sustainable wealth; it's time to transform your investment strategy with modern wealth management.

Goals-Based Investment Planning

Your goals are the foundation for customized portfolios comprising of passive and active solutions, with access to public and private markets. The objectives we define for your investment portfolio, and the specific investments we recommend, are a carefully considered reflection of your master financial plan as well your individual investment preferences.

Customized Investment Portfolios

Portfolios should reflect a firm's best thinking and, of course, you. While all investors face the same capital markets, each has their own unique goals, circumstances, and preferences. Whether you prefer individual securities, ETFs, mutual funds or private strategies, we have developed an enhanced open architecture platform that provides you our best ideas for your portfolio.

Tax-efficient

Strategic, data-driven investing that seeks ambitious results

Passive & active investment solutions

Curated asset mix

Diversified holdings to help reduce expected risk

Access to private investments

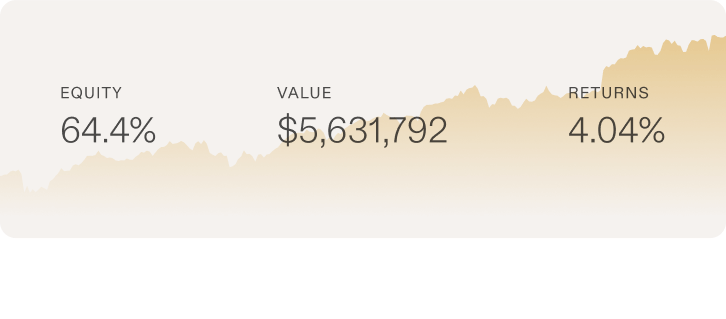

*Illustrative purposes only. Performance is not guaranteed

Diverse investment strategies

Fiduciary advisors who utilize an unbiased and transparent approach to investment management.

Individual securities

This customized approach allows for personalized investment advice and recommendations, seeking to maximize the potential for growth and minimizing risk while taking into account each investor's preferences. Dividend-focused stock portfolios, Growth stock portfolios, Treasury Bond ladders, and Municipal Bond ladders are some examples of strategies that can be customized for each investor. From individual stocks to exchange traded funds (ETF's) to treasury bonds. There are no limits.

KPW TactiCore portfolios

KPW TactiCore is a proprietary strategy that involves actively adjusting the composition of a portfolio based on market conditions and investment opportunities. This approach aims to maximize returns and minimize risks by making strategic shifts in asset allocation and sector weightings, rotating into different sectors or asset classes, or adjusting exposure to certain regions or countries. Learn how tactical investing may work for you.

Socially responsible

Socially responsible investing, also known as sustainable investing, impact investing, or ESG, is an investment approach that considers both financial return and societal impact. This investment strategy aims to generate positive social and environmental change by allocating capital to companies and projects that promote sustainability and ethical practices. Learn more about Socially Responsible investing here.

Third party managers

Access to third-party asset managers, who apply their unique insights, experience, and investment acumen on your behalf.

We continually review strategies and asset managers that may be appropriate for certain investors and their goals.

Alternative investments

Alternative or Private investments can provide added diversification and long term rewards to a well balanced portfolio. We have access to non-publicly traded investments such as private equity, private real estate, hedge funds, private debt offerings, and even fine wine and rare spirits. However, it is important to note that alternative investments may not be suitable for all investors. Learn more about Alternative Investments here.

Direct indexing strategies

Custom tax-sensitive strategies and direct indexing portfolios can increase an investor's after-tax return. This approach can minimize capital gains taxes by utilizing tax-loss harvesting and smart selling. Overall, direct indexing provides investors with greater control, tax advantages, and diversification opportunities for their investment portfolios. Learn more about the Savvy Direct Indexing platform.